March 14, 2024

Southern Company Update, 4th Quarter 2023

Southern Company had a respectable end of the year for 2023 regarding the growth of its business. Usually with electric utilities, no news is good news. Since there was not a significant event in the earnings call, the utility business should continue as expected with steady earnings growth based on Southern Company forecasts.

In this case, 2023 earnings per share (EPS) results hit the top end of full year guidance from management. That’s about a 2% growth rate over 2022 results. Management also guided 2024 EPS at a 10% growth rate at the midpoint target of $4/share. Management also expects long term EPS growth in a 5-7% range. Again, typically these growth rates are fairly predictable, barring any significant events like the decommissioning of the Kemper coal gasification plant or the cost overruns from Vogtle units 3 & 4.

Speaking of which, Vogtle unit 4 achieved criticality on Valentines day, which means they’re on the last steps to getting unit 4 on the grid and commercially viable. Management guided unit 4 completion in the 2nd quarter. This does represent another delay in the completion of the most recently constructed nuclear reactor in the country, but remaining estimated costs are only $189m. Unit 3 has been operating since June 2023.

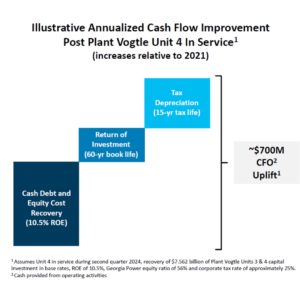

With both nuclear reactors online, Southern Company is expected to recover debt and equity costs of 10.5% return on equity (rate increases coming). The plant is expected to have a 60 year book life and a 15-year tax depreciation shield that should increase cash flows from operations (CFO) by around $700 million per year, according to the latest results. The impact on cash flows has been illustrated in the latest earnings report:

Source: Fourth Quarter 2023 Earnings Conference Call, Southern Company. Slide 30.

Ultimately, with the cost overruns in the rearview mirror, Southern Company will likely enjoy cost input stability with the new nuclear reactors. Therefore, fluctuations in natural gas or coal prices will have less of an impact on costs which leads to further predictability of earnings growth.

Currently, Southern Company has a dividend yield, price-to-earnings, and price-to-book valuation in line with historical averages. Southern is also priced in line with other comparable utilities. This implies that there is neither company specific risk related to over-valuation nor is there opportunity based solely on valuations.

Utilities do tend to underperform in rising interest rate environments like 2022 and 2023. Our opinion is in line with consensus that we are at the peak of the short-term rate hike cycle, but long-term rates move independently of the Fed’s activity. Spikes in overall interest rates would affect borrowing costs for utilities like Southern Company and put a damper on profitability. Alternatively, if interest rates stabilize or fall, then that should be a tailwind for utilities and Southern Company.

Unlike the investor experience between 2016-2020, the ride in 2020-2024 has been relatively drama free. Hopefully that trend continues and Southern Company investors can enjoy a stable utility investor experience.

Sources:

- Southern Company Investor Relations. “Fourth Quarter 2023 Earnings Conference Call.” February 15, 2024. Slide deck. Retrieved from https://investor.southerncompany.com/home/default.aspx

Earnings per share (EPS) is a company’s net income subtracted by preferred dividends and then divided by the average number of common shares outstanding.

The price-to-earnings (P/E) ratio measures a company’s share price relative to its earnings per share (EPS).

The price-to-book (P/B) ratio measures the market’s valuation of a company relative to its book value.

This material is for informational or educational purposes only.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.