February 28, 2024

Interest Rates & Inflation – What Gives?

Last I (Ian) checked, the year is 2024, not 2022, so why are we still talking about interest rates and inflation? The markets seem to be humming along. Our government keeps publishing GDP numbers that put any inkling of a recession in doubt. Consumers continue to spend their money like they always have. But just as we started popping the champagne on easing inflation and the hopes of interest rate decreases, inflation decided it has some life left in it. January’s CPI report came in hotter than expected, a 3.1% increase from the year prior vs 2.9% expected. Core inflation came in equally as hot running at 3.9% y/y vs 3.7% expected. This seems like a small difference so why does such a small difference matter so much? Should we really be concerned about inflation clawing its way back like it did back in the 1970s and 1980s?

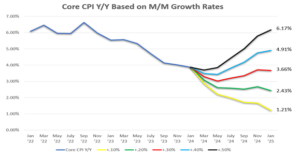

First off, it is important to keep in mind that the stated goal of the Fed is to bring inflation back down to a 2% annual rate. This is of course why interest rates are where they are. Let’s dissect inflation a little further. Like I mentioned, January’s reading told us inflation was up 3.1% annually and Core CPI was up 3.9%. Core CPI is stickier in nature since it strips out the two most volatile inflation gauges: food and energy. Food and energy prices move a lot faster and in greater quantities than other categories such as transportation and housing. This is why it is important to look at Core CPI since it gives us a more focused picture of what exactly is under the hood of the economy. For inflation to continue its drop down to that coveted 2% goal, monthly increases in CPI need to come down. In January, core CPI increased .39% compared to the month prior. If that rate continues, inflation will increase back up between 4-5% in short order. Here is a graph below to illustrate my point:

We saw the month-to-month number creep up to around .3% in November and December and with January being a .39% increase, our current trajectory is somewhere in between the red and light blue lines. If the .4% month-to-month increase continues, we will end up at a 4.91% inflation rate by January of next year. The Fed will have no interest in cutting interest rates unless inflation continues its decline, which means it needs to grow at a .10%-.25% month-to-month rate over the next 12 months.

Now, what happens when interest rates go down? The first thing is that new bonds will be issued at lower yields and existing bonds will rise in price. New mortgages and loans will also carry lower interest rates than they do now. This will more than likely unlock some of the housing market in which a lot of people have been reluctant to sell their houses that carry a 2-3% mortgage rate for a new home that would have a mortgage rate in the 7-8% range. The same could be true for cars, investment properties, and new building projects. What about the stock market? In the absence of having a crystal ball that tells us exactly which stocks to buy and when, there are general trends to keep in mind. As interest rates go up, stock prices tend to go down. The opposite is usually true as well. In particular, dividend paying stocks are very sensitive to interest rates. As interest rates increase, investors are more likely to buy a bond that provides them the same yield as a stock under the assumption that the bond is a less risky investment. However, as interest rates come down, investors will begin buying stocks that provide a dividend yield that is higher than they are able to get on the lower interest rate bonds. This will then cause the prices of the dividend paying stocks to appreciate and thus increasing performance outside of the dividend yield.

So, should we be worried about stagflation like the economy experienced in the 1970s and 80s? I think it would be surprising to see inflation settle in the double-digit range like it did then. The US relies more heavily on services rather than goods now, whereas it was the other way around back then. It is much more difficult to increase supply when you must build a new factory and produce more product than it is to click a few buttons to create more product like it is today. Along with a few other economic innovations, I do not see us experiencing quite the pain that was felt 40-50 years ago.

Like I mentioned earlier, I wish I had this magic crystal ball that could give us all of the answers. When it comes to the markets and economy, we take a long-term view of the companies we invest in. We are comfortable investing in companies that grow their cash flow and focus on returning value to their shareholders. This helps keep things in view as our country and the media continues to push short-term satisfaction over long-term success.