February 22, 2024

Market Update: February 2024

Welcome to the Monthly Market Update from Signature Wealth Management. I’m Brian Ransom, Research Director from Signature Wealth, and here’s what happened in the market this month.

Let’s do a quick review of market performance over the last year.

- The market cap-weighted S&P 500, shown in blue, had a nice rally to end 2023, returning 22% trough-to-peak including hitting the 5000 point mark for the S&P 500.

- The equal weighted index shown in purple has largely underperformed the S&P 500 for most of the last year but did participate in the year end rally, up 20%.

- Both indices had a nasty pullback on February 13, 2024 that resulted in over 90% of stocks down on the day.

- The reason for the pullback was primarily caused by the I-word: Inflation.

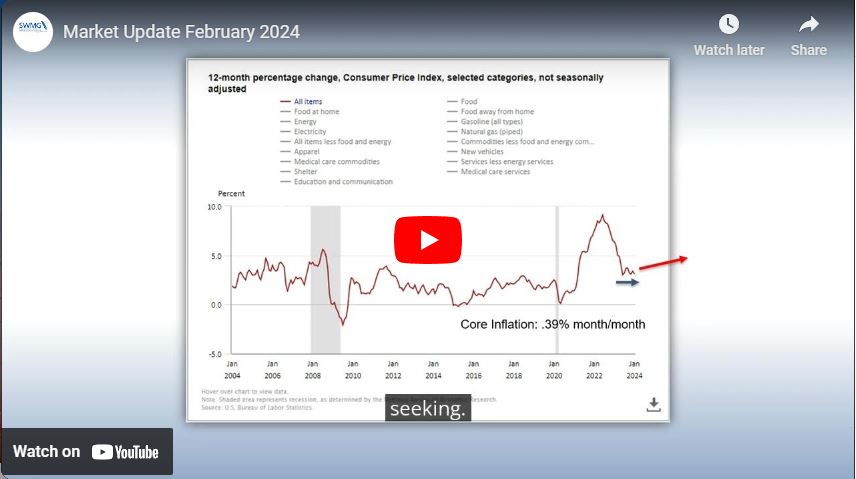

The reason why the market responded negatively to the latest CPI reading is that CPI didn’t actually fall in January like we were expecting.

- In fact, total CPI has been moving sideways around 3% inflation for the last couple of readings.

- Core inflation, the primary driver of inflation felt by the consumer, ticked in a .39% month/month.

- Poor reading because consistent .4% month/month readings leads to rising inflation over the next year.

- Need to get month/month core readings below .3% to see the target 2% inflation rate the Fed is seeking.

The CPI reading caused a dramatic shift in the bond market including a 20 bps spike in the 10 year treasury yield shown here.

- In fact, the entire yield curve experienced a parallel shift higher, resetting expectations for interest rate cuts from the Fed.

Prior to this week, the market was anticipating the Federal Reserve cutting rates 4 times for 100 bps worth of cuts by the end of the year.

- Expectations have now shifted down to an even distribution of 100 bps, 75 bps, and 50 bps of cuts by the end of 2024.

- Rising chance of only 1 rate cut or even 0 cuts.

- Because the market had anticipated looser monetary conditions, the bond and stock market traded higher. Now because of higher CPI prints, the market is pricing in continued tight monetary policy from the Federal Reserve.

One last note here, just this past week, Japan, the UK, Germany, and the Eurozone have all entered into a recession.

- Before anyone hits the alarm bell here, it appears that all 4 recessions look mild.

- Mild enough that despite the classification, all 4 stock market’s are already at all-time highs or are bumping up against all-time highs as shown here. Japan in blue, Eurozone in Yellow, the UK in purple, and Germany in Green.

- Reminder: the stock market is forward looking and recession classifications are backward looking. Thus, the stock market is already looking past these recessions.

Thanks for joining for the monthly market update! We have a new podcast called “Business Tales.” You can find Business Tales on all your favorite podcasting apps. Also, our website is full of economic, financial planning, and market content. For those looking for more information please visit our website at signaturewmg.com. And don’t forget to like and subscribe.

Sources:

1.FactSet Research Systems. (n.d.). S&P 500 & Equal Weight S&P 500 (Interactive Charts). Retrieved February 16, 2024, from FactSet Database.

2.Bureau of Labor Statistics. Consumer Price Index. “12-month percentage change chart, selected categories (past 20 years).” Updated February 13, 2024. Retrieved from https://www.bls.gov/cpi/

3.FactSet Research Systems. (n.d.). Yield Curve (Markets). Retrieved February 16, 2024, from FactSet Database.

4.FactSet Research Systems. (n.d.). 10 year Treasury Yield (Interactive Charts). Retrieved February 16, 2024, from FactSet Database.

5.FactSet Research Systems. (n.d.). Policy Rate Tracker (markets). Retrieved February 16, 2024, from FactSet Database.

6.FactSet Research Systems. (n.d.). MSCI Japan, MSCI Germany, FTSE UK, and FTSE Eurozone (Interactive Charts). Retrieved February 16, 2024, from FactSet Database.

Disclosures:

Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.

Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.

Information contained herein does not involve the rendering of personalized investment advice, but is limited to the dissemination of general information.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Always consult an attorney or tax professional regarding your specific legal or tax situation.

Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. The use of words such as “will”, “may”, “could”, “should”, and “would”, as well as any other statement that necessarily depends on future events, are intended to identify forward-looking statements.

Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

The S&P U.S. Style Indices measure the performance of U.S. equities fully or partially categorized as either growth or value stocks, as determined by Style Scores for each security. The Style series is weighted by float-adjusted market capitalization (FMC), and the Pure Style index series is weighted by Style Score subject to the rules described in Index Construction.

All information presented prior to an index’s Launch Date is hypothetical (back-tested), not actual performance. The Index returns shown do not represent the results of actual trading of investable assets/securities. S&P Dow Jones Indices LLC maintains the Index and calculates the Index levels and performance shown or discussed, but does not manage actual assets. Please refer to the methodology paper for the Index, available at www.spdji.com for more details about the index, including the manner in which it is rebalanced, the timing of such rebalancing, criteria for additions and deletions, as well as all index calculations.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

As of June 2007 the MSCI EAFE Index consisted of the following 21 developed market countries: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece,

Hong Kong, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. (Total Return Index) – With Net Dividends:

Approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to non-resident individuals who do not benefit from double

taxation treaties. MSCI Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates.

The FTSE World Index is a market-capitalization weighted index representing the performance of the large and mid-cap stocks from the Developed and Advanced Emerging segments of the FTSE Global Equity Index Series and covers 90-95% of the investable market capitalization. The index is suitable as the basis for investment products, such as funds, derivatives and exchange-traded funds. 5-Year Performance – Total Return

The FTSE UK Series is designed to represent the performance of UK companies, providing market participants with a comprehensive and complementary set of indexes that measure the performance of all capital and industry segments of the UK equity market.

The MSCI Japan Index is designed to measure the performance of the large and mid-cap segments of the Japanese market. With 225 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in Japan.

The MSCI Germany Index is designed to measure the performance of the large and mid-cap segments of the German market. With 58 constituents, the index covers about 85% of the equity universe in Germany.