August 12, 2025

Southern Company Update, 2nd Quarter 2025

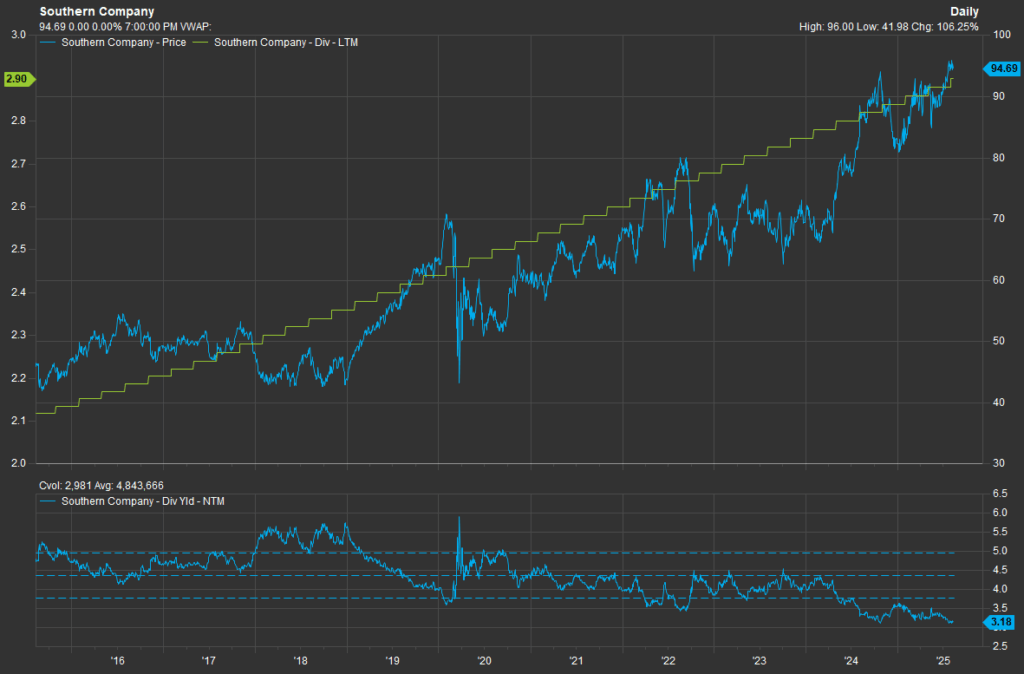

Southern Company results continue to be good and investors have rewarded SO and other utilities with returns typically not seen in the utility space. Southern Company, as of August 11, 2025, is up 36% over two years, 9% over the last year, and 15% year-to-date. Consistent growth in earnings and the dividend combined with the prospects of strong future growth driven by data center buildouts have turned the utility sector into the 4th highest returning business grouping so far in 2025 behind Technology, Communications Services, and Industrials.

But, there is a lot of work ahead for all utilities, especially utilities on the East Coast, to continue to build power generation and supply to meet the growing demand from data centers. With the latest quarterly results, Amazon, Google, Microsoft, and Meta have all roughly doubled their capital expenditures over the last year building out data center capacity for their new AI models. Amazon alone spent $32 billion in 3 months! As discussed in previous updates, these data centers need power. A lot of it. And that falls on Southern Company to build out and take advantage of the growing demand.

Here is the latest update on Georgia Power growth. Georgia Power applied for new resources for nearly 10 gigawatts of power. This includes 3.7 gigawatts from 5 new natural gas-powered combined cycle units spread out throughout the state including two in Bartow County (Plant Bowen), one in Effingham County (Plant McIntosh), and two in Heard County (Plant Wansley). They also intend on building new, Georgia Power-owned Battery Energy Storage Systems (BESS) along with a couple new Solar powered BESS facilities. In total, this will add 10 new gigawatts when factoring in power purchasing agreements. All of this has been submitted to the Georgia Public Service Commission and is awaiting approval as of August 6, 2025.

The new construction is primarily to meet the rising demand from 15,000 new residential customers in Q2 and the 13% increase in data center usage for the quarter. Of the 10 Gigawatts committed, 6 have already been contracted and Southern Company intends to add 50 Gigawatts by the mid-2030’s to meet the surge in electricity demand.

Importantly, in the prior quarterly update written in May, Southern Company increased its capital spending plan by 30% to $63 billion over the next 4 years. Just three months later, the capital spending plan is now at $76 billion, a further $13 billion or 21% increase. $10 billion will go to the new resources laid out above, $2 billion on updates on existing power generation fleets, and $1 billion on wind turbines.

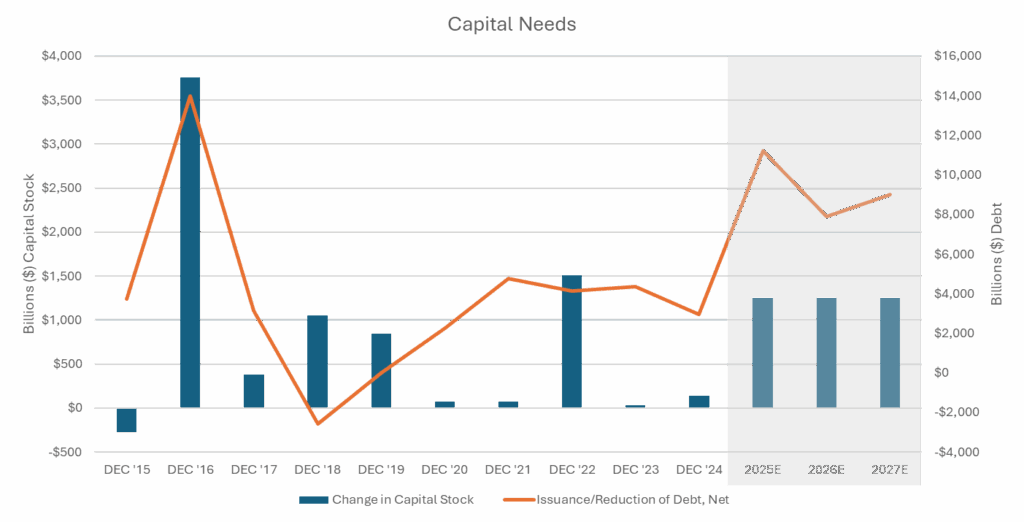

Southern Company increased its equity need projection by $1.2 billion to $5 billion in equity issuance through 2029. This is $1.25 billion a year which is a general increase in capital stock issuance over the last several years albeit $1.5 billion was issued in 2022. Southern also intends on issuing $11.2 billion, $7.9 billion, and $9 billion in debt for 2025, 2026, and 2027, respectively. This is also a general increase in debt issuance from the previous decade.

Source: Factset Database

While this seems like a lot of spending (and it is), Georgia Power gets to recoup its investments through PSC sanctioned increases in power rates capped at specific “returns on equity” (ROE). These ROE’s are a 10.5% target and an 11.9% cap. This means if Georgia Power is issuing $5 billion of equity, they will be allowed to generate $525 million in additional earnings from their new customer contracts. Typically, this occurs via rate increases on existing customers but the most recent updates indicate that the additional $525 million will come from the new customers building out the data centers. Should these large investments impact Georgia Power customer expenses, I suspect the voting block will find it intolerable. But these data center contracts should result in increased cash flow for Southern Company without impacting current customer rates.

Ultimately, prospects for Southern Company as a business remain positive. However, the stock is quite richly valued. The dividend yield is near a 10-year low while the stock price sits near all-time highs. But the absolute yield (~3%) is well above the S&P 500 yield (~1.5%). So dividend investors can receive a decent yield in a stock with a lot of momentum and a clear path forward for growth.

Source: Factset Database

Sources:

1. Georgia Power. “Georgia Power requests certification of approximately 9,900 MW of new resources from the Georgia Public Service Commission.” July 31, 2025. Retrieved from https://www.georgiapower.com/news-hub/press-releases/georgia-power-requests-certification-of-approximately-9900-mw-of-new-resources-from-the-georgia-psc.html

2. Georgia Power. 2025 Integrated Resource Plan. January 2025. Docket No. 56002. Retrieved from https://www.georgiapower.com/about/company/filings/irp.html

Disclosures:

Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth Management Group only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.

This report is a publication of Signature Wealth Management Group. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.

Information contained herein does not involve the rendering of personalized investment advice, but is limited to the dissemination of general information. A professional adviser should be consulted before implementing any of the strategies or options presented.

Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), or product made reference to directly or indirectly, will be profitable or equal to past performance levels.