May 8, 2025

Southern Company Update, 1st Quarter 2025

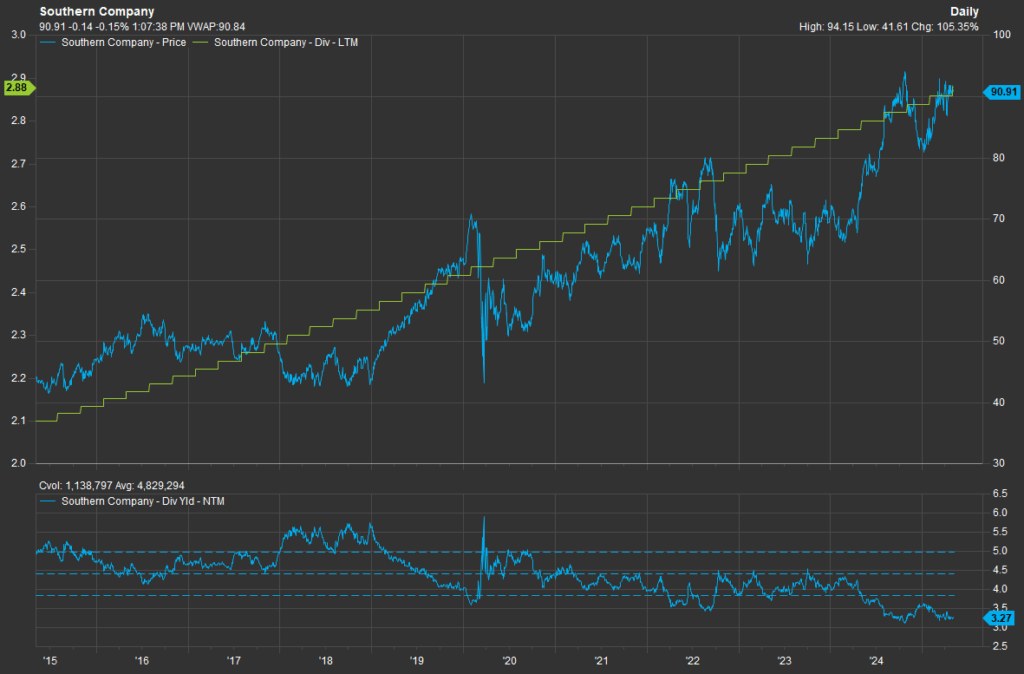

Southern Company has weathered the 2025 volatility well and is trading near the 52-week high as of May 5, 2025.

For the first quarter of 2025, Southern saw a -1.8% decline in residential electricity sales that was almost entirely offset by a 0.5% growth rate in both Commercial and Industrial sales including an 11% increase from the data centers (1). Data center electricity demand is projected to continue to increase nationwide, driving the first secular period of power demand growth in almost twenty years. This is a dramatic shift in outlook from even 5 years ago when Southern Company was decommissioning coal-fired plants and replacing that capacity with the new nuclear facility in Vogtle. But this emerging demand driver has been the primary theme propelling SO and other utility stocks to all-time highs while carrying new capital spending implications as outlined below.

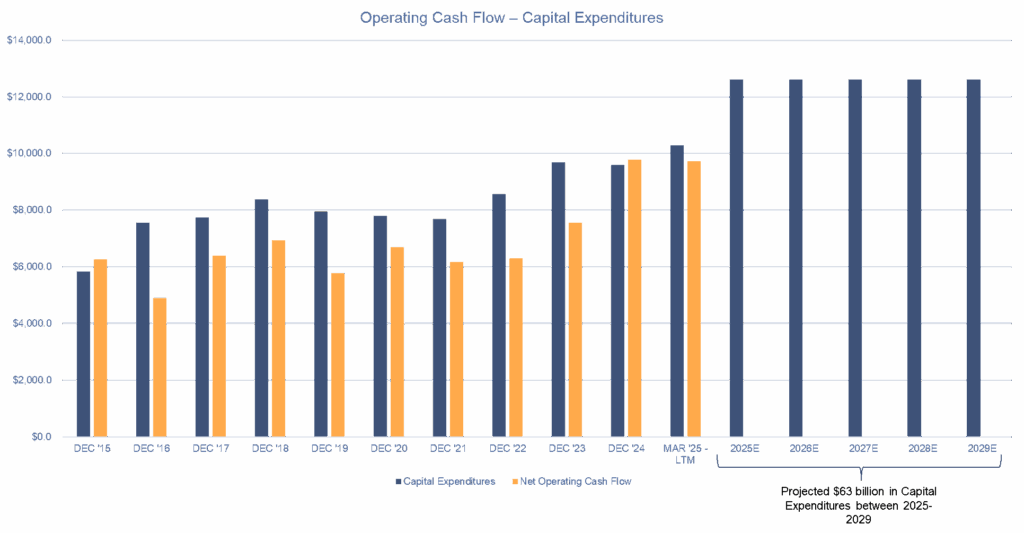

To meet that growing demand, Southern Company increased its capital spending plan by 30% to $63 billion between 2025 and 2029. Over the last 10 years, Southern Company has run a capital spending deficit where capital expenditures exceeded net operating cash flow. This is not unusual for utilities which are typically capital intensive. The additional demand on the grid should result in about $2-3 billion in additional capital spending per year from 2024 levels.

Part of the problem with including a $2-3 billion increase in capital spending is sourcing the capital needed to fund the projects. Because capital expenditures are not funded from operating cash flow, any additional capital projects tend to be funded from additional debt and equity which can be dilutive to shareholders. But the new capital, specifically equity capital, allows Southern Company to increase energy rates on customers to recover additional capital spent on the new projects if approved by the Public Service Commission (PSC). This also means that Southern Company must be measured in their rate increase requests as well because too many rate increases creates a groundswell of outcry from customers to the publicly elected members of the PSC. But this is essentially how utilities drive earnings growth: identify new projects, get approval from the PSC for the new project, raise capital for the new project, increase rates on customers, and increase earnings per share based on a maximum return on equity capital set by the PSC.

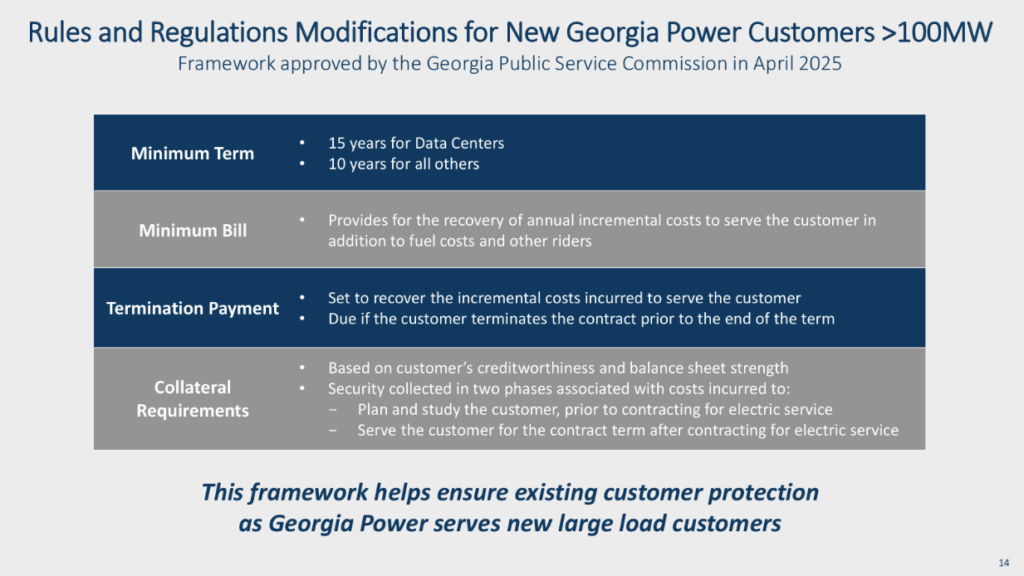

Fortunately, Southern Company offered some interesting clarity on their latest earnings call regarding the contractual terms for their new data center customers, approved by the Georgia PSC. New data center customers must agree to a 15-year minimum contract that covers the new additions to the grid, power supply, and fuel costs. Early termination of the contract results in a lump sum payment. Thus, protecting the residential populace from excessive rate increases and themselves from the subsequent political backlash.

Source: Southern Company 1Q2025 Earnings Call Slide Deck, slide 14.

Also included in the earnings call was a 3.5% dividend increase. Southern Company has now gone 23 straight years of uninterrupted dividend increases. The stock currently yields 3.3% as of May 5, 2025. This yield is trading about 20% below the 5-year yield average of 4.0%. Based on the 10-year graph below, SO stock is trading well below the historical average on dividend yield (the declining blue line at the bottom of the graph represents dividend yield). The promise of a secular power demand driver from datacenters has pushed this stock higher (along with other utilities) without actually increasing growth of profitability. At least not yet. The terms of service for large Georgia Power customers is certainly a step in the right direction as it allows Georgia Power to lock in “growth” from these new data centers coming to the state.

Source: Factset Database

Sources:

- Southern Company. First Quarter 2025 Earnings Conference Call. May 1, 2025. Slide 14. Retrieved from Southern Company Investor Relations.

- Georgia Power. 2025 Integrated Resource Plan. January 2025. Docket No. 56002. Retrieved from https://www.georgiapower.com/about/company/filings/irp.html

Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth Management Group only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.

This report is a publication of Signature Wealth Management Group. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.

Information contained herein does not involve the rendering of personalized investment advice, but is limited to the dissemination of general information. A professional adviser should be consulted before implementing any of the strategies or options presented.

Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), or product made reference to directly or indirectly, will be profitable or equal to past performance levels.