February 16, 2024

NextEra Energy Update; February 2024

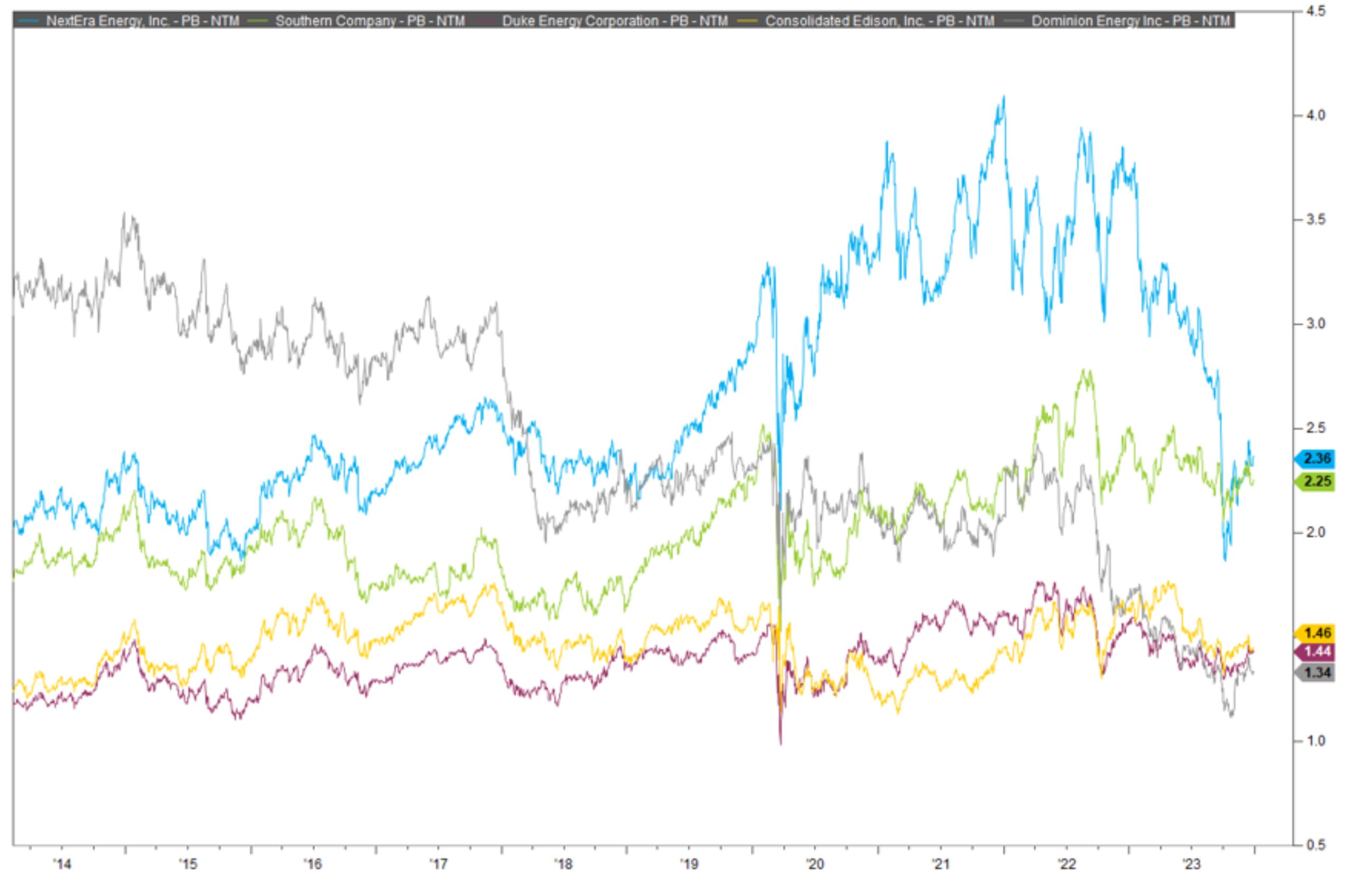

NextEra Energy was once the clean and innovative center of the Southeast’s utility grid. And they still are. But over the last year, the stock market has repriced the value of NextEra Energy stock (NYSE: NEE). Prior to 2023, NextEra stock typically fetched a valuation premium over similar utilities because of a perceived higher growth rate on earnings as well as stability of earnings generation. Thus, as depicted below, throughout most of 2018-2022, NextEra stock had a higher price-to-book-value valuation that the other major utilities in the area.

Source: Factset. Pictured: Price-to-book-value, next twelve months for NextEra Energy (blue), Southern Company (green), Duke Energy (purple), Consolidated Edison (orange/yellow), and Dominion Energy (grey).

Source: Factset. Pictured: Price-to-book-value, next twelve months for NextEra Energy (blue), Southern Company (green), Duke Energy (purple), Consolidated Edison (orange/yellow), and Dominion Energy (grey).

However, following the repricing of NextEra Energy Partners (NYSE: NEP) dividend distributions, it became clear that NextEra was going to have the same problem the other utilities were going to have: borrowing costs were rising and eating into earnings. Thus, Mr. Market felt it was prudent to reprice NextEra stock down to the levels of the other utilities.

This doesn’t mean that NextEra’s business is in jeopardy. In fact, the latest earnings call indicated that business was strong in 2023 (outside of the NEP debacle) with earnings up 9.3% from the prior year. Management even affirmed its 2024 guidance at the year end call. The investor experience in 2023 is simply a reflection of the overpricing in 2021 and 2022.

Now that valuations are more in line with peers, fundamental stability with NextEra’s cash generating assets should result in a more positive pathway forward for NEE stock. After all, forward expectations on cash flow growth have not changed. However, given that elevated interest rates make bonds and cash compelling alternatives to utilities stock, and the collapse in natural gas prices making wind and solar generation assets less price competitive, the days of premium pricing for NextEra might be over and we should expect a growth rate much more in line with its earnings growth than multiple expansion.

Source:

FactSet Research Systems. (n.d.). NEE, SO, DUK, ED, D PB NTM (Interactive Charts). Retrieved February 9, 2024, from FactSet Database.

Disclaimers:

Price-to-book ratio is the price divided by book value per share.

This material is for informational or educational purposes only.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

Consult your financial professional before making any investment decision.