May 1, 2025

Market Update: April 29, 2025

Welcome to the Monthly Market Update from Signature Wealth Management. I’m Brian Ransom, Research Director from Signature Wealth and here’s what happened in the market this month.

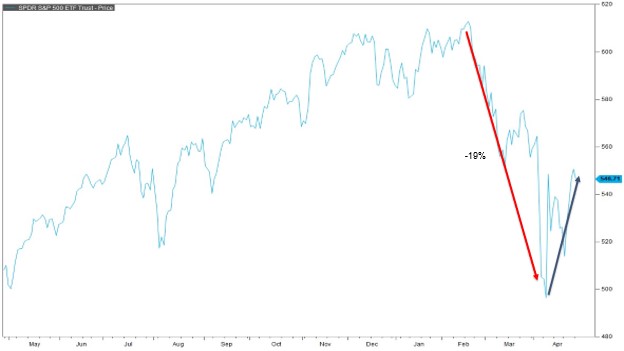

We have just experienced an incredibly volatile month of April that included a 19% peak-to-trough decline in the S&P 500. The market quickly reached oversold conditions and has since recovered a little less than half of the value lost during the decline. The primary cause of the market decline was tariffs and trade policy.

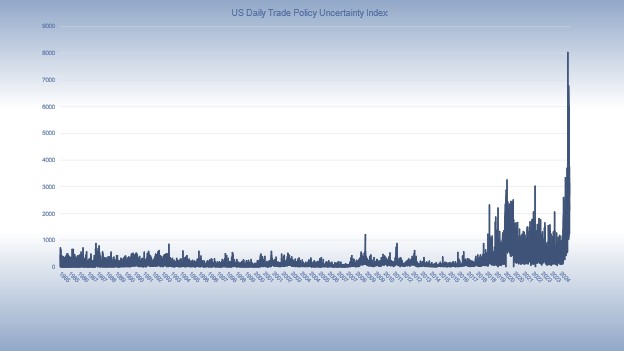

Trade & trade policy is front and center for the economy and the media at the moment. Shown here is the US daily trade policy uncertainty index that reflects the frequency of articles in US newspapers that discuss trade uncertainty. In the past, trade is typically on the back page of the wall street journal. But currently, trade is clearly top of mind for the media and their readers.

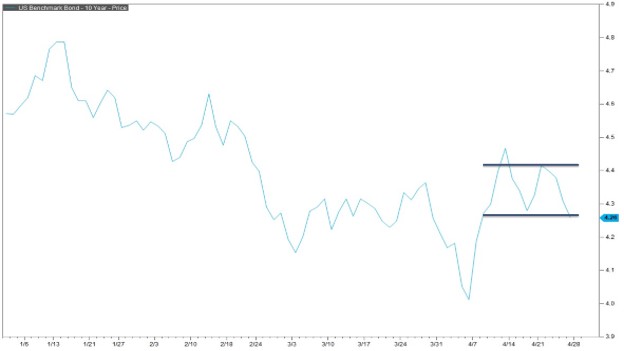

The selloff in the equity markets was fairly violent. Shown here is the volatility index or the VIX. This index tends to spike when selling intensifies and is often a sign of peak selling within the markets. The higher this index spikes, the more volatile the trading is. This big guy here is March of 2020 for reference. So we did experience a very significant selling event in the stock market. The selloff got particularly scary in the days following the Trump administrations global tariff announcement in early April. During this time, US treasuries sold off at a significant clip, causing treasury yields to spike. Typically, when stocks sell off, you often see a flight to safety into the treasury market, bidding up US bonds and dropping yields. So it’s unusual to see both the treasury and the stock market sell off at the exact same time. We have since seen the treasury market stabilize a bit as a 90-day pause on new tariffs was instituted. This caused the stock market selling to reside as well.

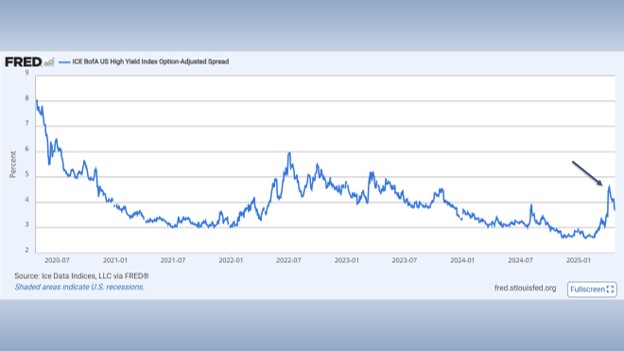

Likewise, we saw a fairly significant spike in the high yield bond spread. This index measures the difference in yields between higher-risk junk bonds and the much safer yields from the US treasury index. Typically, this spread falls as the economy strengthens and spikes when there is significant pressure on the economy. Notably, this index has also fallen with the onset of the 90-day tariff pause further indicating that we have stepped away from the “edge.”

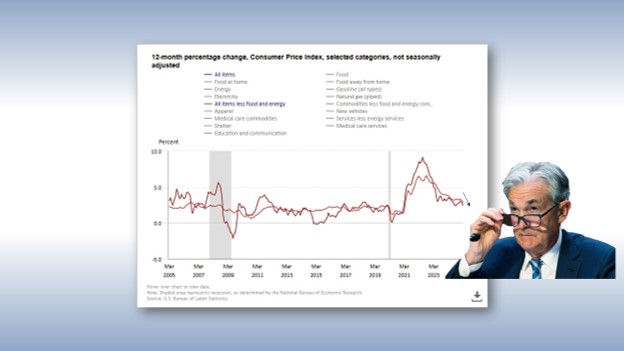

The good news is that tariff announcements haven’t yet affected total CPI or core CPI through the end of March. And as long as inflation continues to fall then that gives the Federal Reserve the flexibility to continue to lower rates to help boost the economy in the event that severe stress hits the economy. As it stands today, April 28, the bond market is pricing in 4, maybe 5 rate cuts in 2025.

Thanks for joining for the monthly market update! We have a new podcast called “Business Tales.” You can find Business Tales on all your favorite podcasting apps. Also, our website is full of economic, financial planning, and market content. For those looking for more information please visit our website at signaturewmg.com. And don’t forget to like and subscribe.

Sources:

- FactSet Research Systems. (n.d.). S&P 500 (Interactive Charts). Retrieved April 28, 2025, from FactSet Database.

- Economic Policy Uncertainty. “US Daily Trade policy Uncertainty Index”. Retrieved April 28, 2025 from https://www.policyuncertainty.com/trade_uncertainty.html

- FactSet Research Systems. (n.d.). VIX (Interactive Charts). Retrieved April, 2025, from FactSet Database.

- Financial Times. “US Treasuries sell-off deepens as ‘safe haven’ status challenged.” Retrieved from https://www.ft.com/content/0005e091-930d-46ff-9e81-8591704a9282

- FactSet Research Systems. (n.d.). 10 Year Treasury Yield (Interactive Charts). Retrieved April 28, 2025, from FactSet Database.

- Ice Data Indices, LLC, ICE BofA US High Yield Index Option-Adjusted Spread [BAMLH0A0HYM2], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLH0A0HYM2, April 28, 2025.

- US Bureau of Labor Statistics. Graphics for economic news releases. “12-month percentage change, Consumer Price Index, selected categories (past 20 years).” Updated April 10, 2025. Retrieved from https://www.bls.gov/cpi/

Disclosures:

Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.

Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.

Information contained herein does not involve the rendering of personalized investment advice, but is limited to the dissemination of general information.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

Always consult an attorney or tax professional regarding your specific legal or tax situation.

Our US Trade Policy Uncertainty Index is a daily version of one of the category-specific Economic Policy Uncertainty (EPU) indexes developed in “Measuring Economic Policy Uncertainty” by Scott R. Baker, Nick Bloom and Steven J. Davis. It reflects the frequency of articles in American newspapers that discuss policy-related economic uncertainty and also contain one or more references to trade policy. For index construction details, please visit the US Categorical EPU Indices page.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. The use of words such as “will”, “may”, “could”, “should”, and “would”, as well as any other statement that necessarily depends on future events, are intended to identify forward-looking statements.

Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

The S&P U.S. Style Indices measure the performance of U.S. equities fully or partially categorized as either growth or value stocks, as determined by Style Scores for each security. The Style series is weighted by float-adjusted market capitalization (FMC), and the Pure Style index series is weighted by Style Score subject to the rules described in Index Construction.

All information presented prior to an index’s Launch Date is hypothetical (back-tested), not actual performance. The Index returns shown do not represent the results of actual trading of investable assets/securities. S&P Dow Jones Indices LLC maintains the Index and calculates the Index levels and performance shown or discussed, but does not manage actual assets. Please refer to the methodology paper for the Index, available at www.spdji.com for more details about the index, including the manner in which it is rebalanced, the timing of such rebalancing, criteria for additions and deletions, as well as all index calculations.