Tackle the Uncertainty

The landscape of professional sports carries continuous change as priorities from the world’s top athletes fits the needs they have in their profession. NFL players model this perfectly. Over the past 3-4 years, NFL athletes are negotiating their contracts to include more guaranteed money, even at the expense of higher potential earnings. Why are they doing this? NFL players are protecting the most valuable asset they have: their income. As individuals, we buy insurance for all the most important things in [...]

Big Bifurcation: 10-year Treasury vs. Equal Weight Consumer Staples

Big bifurcation in momentum between the 10-year treasury yield (purple) and equal weight consumer staples (blue)! Staples are typically low volatility stocks with predictable earnings. But the rapid increase in the 10-year yield has forced a sell-off on both an absolute (top graph) and relative-to-S&P500 basis (bottom graph). Source: FactSet Research Systems. (n.d.). Equal weight consumer staples vs 10-year treasury yield benchmark (Interactive Charts). Retrieved October 12, 2023, from FactSet Database. This material is for informational or educational purposes only. Investing [...]

Current US Debt Level Compared to that of our Country’s History

As you can see from the chart, we’ve added $2 trillion in debt in just a couple months. I'm alarmed by the pace at which the US is adding to its debt on a year over year basis these days, so I decided to do some digging to see what our debt history has looked like. Treasury.gov has a record on US debt back to 1790. For the most part, it vacillated in the $25 million to $80 million range for the first [...]

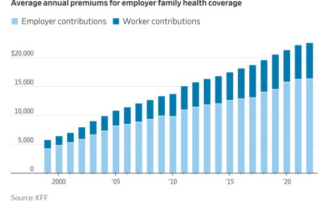

Insurance is a Rapidly Growing Expense

Insurance is a rapidly growing expense, which is taking up more and more of the family budget each year. The average US family health insurance premium in 2000 was $6k. In 2022 the average premium is $22k, which is an increase over that time period of 249% or 5.8%/year. Inflation during that same time averaged 2.5%/year, so the cost of insurance for a family has grown at a rate of more than double that of inflation. In my business, we used to carry [...]

Home Runs and Hard-Earned Savings: Comparing the Atlanta Braves’ 2023 Baseball Season to Personal Finances

As the Atlanta Braves gear up for the playoffs, there's a curious parallel that can be drawn between the world of professional sports and our personal finances. While these two domains may seem worlds apart, they share common threads of planning, management, and the pursuit of success. In this article, we'll explore how the Braves' baseball season resembles our own financial journeys and what lessons we can glean from their playbook. Setting Clear Goals: Just as the Braves aim to win [...]

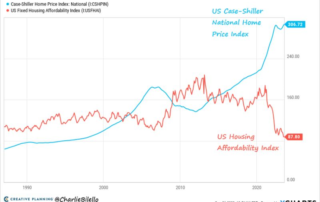

U.S. Home Prices Hit an All Time High in July

U.S Home prices hit an all time high in July while affordability dropped to new lows. How can home prices continue to rise, while affordability drops? The main culprit seems to be a lack of inventory due to limited building of new homes and Americans who are staying put in homes with debt that was financed at very low rates. If you are considering moving to a new home, would you leave a rate of 3% to go to a rate of 7.2%? Not [...]

Help Your Student Qualify For An Uncle Sam Tax Scholarship

When it comes time for your child or children to attend college, will you be able to afford it? This is a question that is burdening many parents, as college tuition inflation has increased at an alarming average rate of 12% annually from 2010 to 2022, while the cost of tuition even at public 4-year institutions increased 9.24% over this same time period1. Strategically, the simplest solution is to begin saving large sums and saving early, but this might not be [...]

Things to Consider When Offered a Severance Package

Getting offered a severance package from your employer can be an exciting and nerve-racking situation, all at the same time. It is important to take a moment and understand your personal situation. It is essential to carefully consider the terms and implications before making a decision. Here are some key factors to take into account: Package Details: Review the specific terms of the severance package, including the amount of compensation, the duration of payments, and any additional benefits (e.g., continuation [...]

Understanding Your Student Loan Situation After Your Recent Graduation

Yay! I survived college and graduated with that valuable piece of paper that I was able to afford with the help of student loans. Now what do I need to know to pay them off? This is a common question many recent graduates, like myself, have asked. To complicate things further, there's been a lot of action in Washington DC to change the way student loans are paid off. How do I know if any of these changes affect me? And [...]